Learn how HRPayHub's bank upload feature streamlines payroll transfers and reduces mistakes

We're living in 2025, where you can literally order jollof rice to your doorstep in 20 minutes, but somehow, paying your team still feels stressful.

There's a fix. It's called bank upload payroll, and it's about to change everything about how you handle salary payments. Let's break it down.

What Is Bank Upload Payroll?

Okay, imagine this. Instead of manually punching in everyone's bank details like you're cracking a safe code, you just click one button. A perfect file pops out with everyone's payment info; names, account numbers, amounts—all formatted exactly how your bank likes it.

That's bank upload payroll in a nutshell.

It's basically a smart system that takes your payroll data and turns it into a file your bank can instantly read and process. No more copy-pasting. No more "did I get that digit right?" anxiety. Just clean, accurate payment files ready to roll.

Think of it like this: your payroll system speaks "HR language," and your bank speaks "bank language." Bank upload payroll? That's the translator sitting in the middle, making sure everyone understands each other perfectly.

If you're using software like HRPayHub's payroll system, this whole dance takes about 5 minutes. Seriously. Five. Minutes.

Compare that to the 4-hour marathon you're probably running now, and suddenly this whole automated thing starts looking pretty sweet.

How Does Payroll Bank Upload Work?

Alright, let's talk about what you actually need to know.

The Setup Part

Your employee management system keeps all your team's banking info on file. Account numbers, bank names, the works. When payroll day rolls around, the system grabs all this verified data along with everyone's calculated pay.

Quick sidebar: setting up direct deposit isn't complicated. You just need each employee's bank name, account number, and routing number. Link those to your business account, and you're golden.

The Magic Translation Bit

Different banks are picky about file formats. Some want CSV files. Others prefer XML. Some have their own weird proprietary formats. (Banks, am I right?)

The beauty of automated systems like HRPayHub is they already know what each bank wants. GTBank format? Check. Access Bank? Got it. UK banks like HSBC or Lloyds? No problem.

You don't need to learn banking file formats—the system handles that headache for you.

The Safety Net

Before anything gets generated, smart systems run checks:

- Are these account numbers actually real?

- Do the amounts add up correctly?

- Anyone listed twice? (It happens!)

- All the required info filled in?

These automatic checks catch mistakes before they become "oops, I paid someone twice" disasters.

The Secure Handoff

File gets generated, encrypted, and ready for your bank's business portal. Upload it, bank validates everything, and bulk payment is processed. Usually within hours.

What Format Is a Payroll File?

So, file formats. Stay with me here—this sounds boring but it's actually important (and not as complicated as it seems).

Nigerian Bank Formats

Most Nigerian banks like Excel files (.xlsx) or CSV files with specific columns:

- Employee name/ID

- Bank name

- Account number

- Account type (savings or current)

- Amount

- Payment reference

Simple enough, right? The catch is that banks don't all use the exact same setup. GTBank might want columns arranged differently than Zenith Bank. Some want extra columns. Others are picky about date formats.

Manually creating files for different banks? That's where the headache begins. Automated systems solve this by knowing each bank's quirks.

UK Bank Formats

UK banks typically use BACS Standard 18 format—basically structured text files with payment instructions in specific positions. Some banks like Lloyds want variations without headers.

Sounds technical, but you don't need to memorize this stuff if you're using proper payroll software.

International Standards

Got global operations? You might deal with:

- NACHA files for US electronic transactions

- SEPA XML for European transfers

- SWIFT MT101 for international payments

Managing multiple formats manually? Recipe for confusion. Using HRPayHub's comprehensive platform? The system juggles all these formats automatically while you focus on actually running your business.

What File Format Do Banks Accept?

Banks are surprisingly picky about this. Use the wrong format? Rejected upload. Delayed payments. Angry employees.

Nigerian Banks

Most accept:

- Excel files (.xlsx) with proper columns

- CSV (Comma-Separated Values) files

- Text files (.txt) with specific delimiters

But here's where it gets interesting. Each bank adds special requirements:

- Specific header rows (or no headers at all)

- Account numbers formatted a certain way

- Character limits on description fields

- Particular date formats

UK Banks

UK banks process:

- BACS files (.txt) for regular domestic payments

- Faster Payments files for same-day stuff

- CHAPS files for urgent, high-value transfers

Different methods, different file structures, different processing speeds.

The Multi-Bank Headache

Now imagine your employees use five different banks. You need five different file versions for one payroll run. Manually? That's a nightmare.

HRPayHub's bank upload solution looks at where everyone banks, applies the right formatting rules automatically, and generates whatever files you need—even multiple bank-specific files at once.

For businesses juggling various banking relationships, this isn't just convenient. It's sanity-saving.

How Do I Upload My Payroll File to My Bank?

Got your file? Great. Here's how to actually get it into your bank's system.

Step 1: Get Into Your Business Portal

Log into your bank's corporate/business internet banking. Make sure you're in the business section—personal banking portals can't handle bulk payments.

Step 2: Find the Bulk Payment Section

Look for labels like:

- "Bulk Payments"

- "Salary Payments"

- "File Upload"

- "Multiple Transfers"

Banks use different names, but you're hunting for the same thing.

Step 3: Choose Your Upload Method

Banks usually offer:

- File upload (do this one!)

- Manual entry (avoid unless you enjoy pain)

Always go with file upload when available. Faster, cleaner, way less room for error.

Step 4: Upload and Check

Hit "Choose File," grab your bank upload file, click "Upload." The bank's system checks your file format.

If everything's good, you'll see a summary:

- Number of transactions

- Total payment amount

- List of recipients

Double-check this against your payroll records. Quick sanity check never hurts.

Step 5: Authorize

Most business accounts need authorization before payments go through. Might involve:

- SMS codes

- Hardware tokens

- Digital signatures

- Multiple approvers

Your file status shows "Upload in Progress," then switches to "Pending" if the format's correct. Authorized users can then approve it.

Step 6: Confirm and Relax

Once authorized, the bank processes everything. Timing varies:

- Some banks process immediately

- Others wait until next business day

- Sometimes depends on when you submit

You'll get confirmation when payments execute. Employees see money hit their accounts according to the bank's schedule.

When Things Go Wrong

Upload failed? Common culprits:

- Wrong file format

- Invalid account numbers

- Not enough money in your account

- Missing authorizations

HRPayHub's system prevents most format and validation errors upfront, so rejections become super rare.

What Is the Bulk Payment File Format?

Bulk payment files organize multiple payment instructions in one structured document. Let's demystify this.

Basic Building Blocks

Every bulk payment file has:

Header Section

- Your company name and account details

- Payment date

- How many transactions

- Total amount you're paying out

- When the file was created

Transaction Details For each person getting paid:

- Their name

- Their bank name or code

- Their account number

- Account type

- Amount

- Payment reference/description

Footer Section

- Transaction count (double-check)

- Total amount (verify)

- Validation code

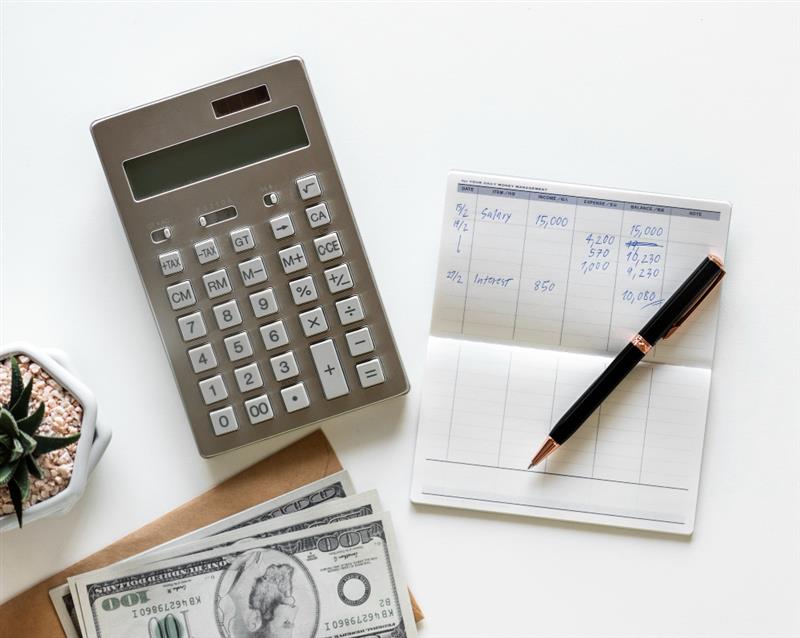

Nigerian Format Example

Nigerian bank upload in Excel typically looks like:

| S/N | Employee Name | Bank Name | Account Number | Amount | Narration |

| 1 | John Doe | GTBank | 0123456789 | 150000 | Salary Oct 2025 |

| 2 | Jane Smith | Access Bank | 0987654321 | 200000 | Salary Oct 2025 |

Some banks want extra columns:

- Bank code (CBN codes)

- Employee ID

- Department

- Payment type

UK Format Example

UK BACS files use fixed-width text where every field sits in exact character positions:

0199TESTCOMPANY LTD 123456 010625

1JOHNDOE 123456 12345678 00015000000

1JANESMITH 234567 87654321 00020000000

9000003000035000000

Each line type (header, detail, footer) follows strict positioning rules.

Precision Matters Big Time

Banks process these files automatically using rigid rules. Extra space? Wrong date format? Misaligned column? Rejected.

Creating files manually invites trouble. HRPayHub's automated generator applies exact formatting rules for each bank, eliminating human error from the equation.

How HRPayHub's Bank Upload works

HRPayHub's automated solution tackles every single pain point we just covered.

One-Click File Generation

Generate bank upload files with literally one click. System grabs your processed payroll data, applies correct bank formatting, produces download-ready files in seconds. Hours of work? Now it's moments.

Multi-Bank Intelligence

Employees banking with different institutions? No stress. HRPayHub generates separate files for each bank, or creates unified files with proper multi-bank coding—depends on what your main bank accepts.

Built-In Quality Checks

Before generating anything, the system validates:

- Account number formats

- Amounts versus payroll totals

- Duplicate entries

- Required fields

- Bank code accuracy

Catches errors before they reach your bank. No rejected uploads. No payment delays.

Format Flexibility

Need Excel for Nigerian banks? BACS files for UK banks? Specialized formats for specific institutions? HRPayHub adapts. The platform maintains updated bank format libraries and applies current requirements automatically. Zero manual configuration needed.

Full Integration

Bank upload connects seamlessly with:

- Complete employee records

- Tax and statutory calculations

- Payslip generation

- Financial reporting

- Statutory remittances

Everything stays consistent across your entire payroll process.

Security Plus Audit Trails

Every file generation creates a permanent record:

- Who generated it

- When it was created

- What data it contained

- Which payroll run it represents

Supports compliance requirements. Provides accountability. Gives you peace of mind.

Advanced Features That Level Up Your Payroll Game

Beyond basic uploads, HRPayHub brings capabilities that transform how you handle payroll entirely.

Full Payment Outsourcing

HRPayHub's Platinum package includes outsourced payment processing. You approve payroll, and HRPayHub's team executes transfers using secure APIs. No file uploads. No portal navigation. No stress.

Perfect for businesses managing multiple payment streams—salaries, statutory remittances, vendor payments—who want complete automation.

Set-and-Forget Scheduling

Set up payment schedules and let HRPayHub run on autopilot. The system automatically:

- Processes payroll on specified dates

- Generates bank files

- Sends notifications when files are ready

- Archives payment records

Consistency guaranteed. Last-minute rushing eliminated.

Approval Workflows

Need oversight? HRPayHub's task management routes files through approval chains. Finance managers review before release. Checks and balances maintained. Efficiency preserved.

Payment Intelligence

Access detailed reports on payment patterns, bank fees, processing times, and payment history. HRPayHub's financial analytics transform raw payment data into strategic insights for optimizing cash flow and negotiating better bank terms.

Exception Handling

Advance payments? Bonuses? Corrections? Partial payments? HRPayHub handles special situations without disrupting regular payroll. Generate supplementary files for off-cycle payments while maintaining complete records.

Pricing That Works for Every Budget

HRPayHub offers flexible packages designed for different needs and company sizes.

Gold Package (₦4,999/£4.99 per user monthly)

Includes bank upload plus:

- Complete payroll management

- Tax calculations and statutory deductions

- Payslip generation

- Monthly PAYE returns

- Annual returns

Great for businesses wanting payroll automation without extra services.

Platinum Package (₦6,999/£6.99 per user monthly)

Everything in Gold, plus:

- Nigerian bank upload files (Payroll Bank Upload File NG)

- UK FPS files for HMRC

- Task management

- Expense management

- Financial reports and analytics

- Digital offer letter signing

Perfect for comprehensive HR, payroll, and financial management.

Add-On Services

Want completely hands-off management? HRPayHub offers pay-as-you-go services:

- Staff Payment Service: ₦25,000—HRPayHub executes salary transfers via secure APIs

- PAYE Remittance: ₦25,000 monthly—complete tax remittance and filing

- Annual Returns: ₦100,000—end-of-year tax filing with state revenue

True payroll outsourcing with full visibility and control.

Ready to Transform Your Payroll?

You've seen how bank upload payroll transforms monthly payment stress into streamlined, reliable processing. You understand how HRPayHub eliminates errors, saves time, and builds better financial management.

Start your free trial with HRPayHub today. Process your first payroll. Generate your first bank file. See how simple it can be.

Choose Gold Package for core payroll automation with bank upload, or select Platinum Package for complete HR, payroll, and financial management.

Need guidance? Contact HRPayHub's team for personalized consultation. We'll assess your needs, demonstrate bank upload features with your banking relationships, and create an implementation plan that minimizes disruption while maximizing

Stop wrestling with payment spreadsheets. Get started with HRPayHub's automated bank upload and transform your payroll today. Your employees—and your stress levels—will thank you.