Payroll automation is reshaping hiring landscape. Explore how integrating recruitment platforms and payroll tools defines the future of work in Nigeria

In the not-so-distant past, Nigerian employers ran payroll with spreadsheets, calculators, and a great deal of stress. Each payday was a test of endurance for HR teams: manually computing salaries, applying tax deductions, reconciling pension contributions, and making sure no one’s paycheck slipped through the cracks.

But the world of work is shifting very fast. Hybrid and remote work are on the rise. Employers are hiring beyond state lines. Recruitment cycles are shorter, expectations are higher, and regulatory complexity is growing. And in this new era, traditional payroll systems are no longer enough.

The modern Nigerian employer needs speed, accuracy, and integration. Payroll automation works as a technical upgrade, and also as a strategic enabler that redefines how we hire and retain talent.

Why Payroll Is Now a Strategic Business Function

Recruitment has always been a priority for businesses, but payroll sits at the heart of employee trust. You can hire the best talent, craft the most appealing job offer, and promise career growth but if you don’t pay people correctly and on time, the entire employment relationship fractures.

Much more than a finance function, Payroll an employer brand statement.

An error-filled payroll tells employees your processes are broken. A smooth, automated payroll experience tells them they’re valued.

Global research from PwC shows that over 44% of employees would lose trust in their employer after just two payroll errors. In Nigeria, where statutory deductions (PAYE, pension, NHF, NHIS) are layered with state-specific tax rules, manual processing is a breeding ground for errors.

Payroll automation transforms this by embedding compliance and accuracy into every transaction, and when integrated with recruitment systems, it eliminates the gap between hiring and paying.

Bridging the Gap Between Hiring and Payroll

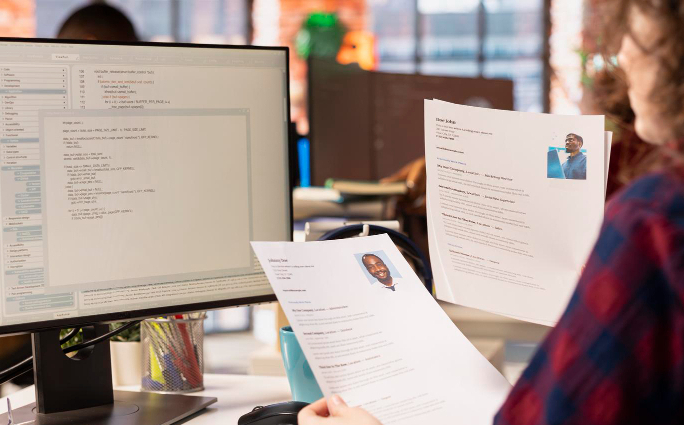

The traditional way:

HR recruits manually or through job boards.

Candidates are hired and entered into multiple spreadsheets or HR forms.

Payroll teams manually input salary data, calculate deductions, and process payments.

Errors creep in, especially when multiple locations and benefits are involved.

The automated way:

Recruitment is done on a platform like Delonjobs.

Candidate information (name, salary, benefits, contract terms) flows directly into the payroll system (HrPayHub).

Payroll runs automatically; deductions, payslips, and statutory remittances happen behind the scenes.

Employees get paid accurately and on time, every time.

This isn’t just about saving time. It’s about removing friction from the employee journey. The first month after hiring sets the tone for retention. A smooth, transparent payroll system communicates trust from the very first day.

How Payroll Automation Transforms the Hiring Lifecycle

Payroll automation is often viewed as a back-office upgrade. But when designed well, it reshapes the entire talent lifecycle. Here’s how:

A. Faster Onboarding

The faster new hires are onboarded into payroll, the faster they feel part of the organization. Automated payroll systems like HrPayHub allow instant employee profile creation once recruitment is completed. This minimizes data entry errors and speeds up Day 1 readiness.

B. Smarter Compensation Design

Payroll data gives HR teams visibility into labor costs in real time. It becomes easier to design competitive compensation packages aligned with budget forecasts. When recruiting at scale, this insight can guide hiring strategy and prevent overcommitment.

C. Seamless Compliance

Every hire comes with a compliance burden: PAYE deductions, pension enrolment, NHIS registration, tax remittances, and more. Manual systems struggle to keep up. An automated system ensures compliance is baked into every payroll cycle, shielding employers from costly penalties.

D. Employer Branding & Employee Experience

People talk about their pay experience. When employees see transparent payslips, consistent payment dates, and accessible records, trust builds. That’s employer branding that no billboard can buy.

Why Integration Is the Future

The Nigerian job market is expanding fast, but so are its complexities. Companies are hiring hybrid workers, remote staff, contractors, and gig professionals across state lines. Integrating recruitment and payroll systems is the only way to scale without chaos.

Integration achieves:

Eliminates Double Data Entry

No more manually copying candidate data from a recruitment form to a payroll sheet. Once a candidate accepts an offer on Delonjobs, their details automatically populate HrPayHub’s system.

Reduces Payroll Errors

Each layer of manual processing introduces risk. Integration eliminates that layer.

Tax calculations are automated.

Pension and NHF contributions are applied accurately.

Overpayments and underpayments drop drastically.

Accelerates Time to First Paycheck

A delayed first salary is a bad start. With integration, new hires can receive their first payslip within their first month and sometimes even within the first two weeks.

Improves Forecasting & Budgeting

Because hiring and payroll data sit in the same ecosystem, finance teams can project future payroll costs based on current recruitment pipelines.

Supports Compliance at Scale

Whether you’re hiring, HrPayHub’s system applies the right state tax rules automatically.

Punch Nigeria lists HrPayHub among Nigeria’s top payroll solutions.

Forward-thinking companies are already using automation to pay faster and to hire smarter.

The Future of Work in Nigeria, From a Payroll Perspective

The Hybrid & Remote Work Boom

The post-pandemic shift toward hybrid work isn’t fading. More Nigerian employers are adopting flexible work structures, hiring beyond physical offices. But this shift brings payroll complications:

Multiple tax jurisdictions for different states.

Different allowance structures (transport vs. remote stipends).

Changing employment contract types.

Payroll automation makes it easier to handle complexity

Gig Work and Contractor Management

Nigeria’s gig economy is expanding. Organizations are hiring freelancers, part-timers, and consultants. Traditional payroll systems weren’t built for this.

Modern solutions like HrPayHub can:

Support multiple pay frequencies (weekly, biweekly, monthly).

Handle contractor deductions and withholding tax automatically.

Keep payment records clean for audits.

This flexibility makes businesses more agile in their hiring models.

AI & Predictive Payroll

Globally, AI is moving into payroll. Predictive payroll can:

Flag anomalies before payments are made.

Forecast salary trends and turnover costs.

Recommend budget adjustments during recruitment planning.

As AI technology becomes more accessible in Nigeria, platforms like HrPayHub are well positioned to embed these capabilities.

Cross-Border Hiring & Multi-Currency Payroll

Nigeria’s growing startup ecosystem is hiring talent across borders. That brings another layer of complexity involving exchange rates, foreign tax obligations, and multi-currency payments.

A strong payroll automation platform is essential to manage these realities without breaking compliance rules.

Regulatory Compliance and Risk Mitigation

Regulatory compliance in Nigeria is a walk in the park. Employers must stay aligned with:

PAYE tax regulations (FIRS & State IRS)

Pension Reform Act

NHF, NHIS, NSITF deductions

Annual returns and filings

Manual errors here can cost organizations huge sums in penalties. Payroll automation with local compliance modules ensures:

Statutory deductions are applied correctly every time.

Remittances are automatically computed and scheduled.

Audit trails are created for every transaction.

This means HR teams spend less time firefighting compliance issues and more time building strategy.

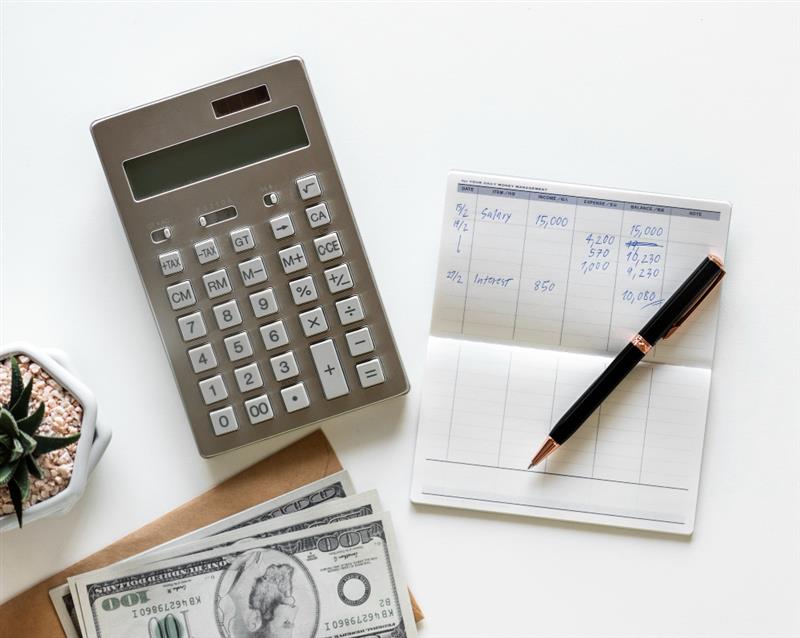

ROI of Payroll Automation

For many employers, automation feels like a cost. But the real story is ROI:

Reduced payroll errors = fewer employee disputes and financial losses.

Faster payroll runs = lower administrative costs.

Regulatory compliance = zero penalties.

Better employee experience = higher retention.

A 2024 Deloitte report shows companies adopting payroll automation save up to 18–25% in HR operational costs annually.

When integrated with recruitment, the cost savings compound. Less paperwork, fewer delays, and happier employees.

The Competitive Edge

In today’s job market, employers compete for customers and top talents. Top talents then look for customers who can offer; transparent hiring processes, efficient onboarding, reliable payroll, compliance with labour laws, modern digital tools.

By integrating hiring and payroll, businesses can build this competitive edge. This is all technology and creating a better workplace experience that attracts and retains great people.

Common Pitfalls and How to Avoid Them

No transformation is without challenges. Many companies make avoidable mistakes when adopting payroll automation.

Mistake 1: Treating Payroll as a Tech Upgrade Only

Automation is a software that helps in the shift on how you manage people. Get HR, finance, and leadership on board from the start.

Mistake 2: Ignoring Data Quality

Garbage in, garbage out. Before integrating recruitment and payroll systems, clean up employee data.

Mistake 3: Not Training HR Teams

Even the best system fails with poor adoption. Invest in training your HR staff to use new tools effectively.

Mistake 4: Neglecting Compliance Updates

Tax rules change. Ensure your provider updates its compliance modules regularly.

Best Practices for Employers & HR Professionals

Start small and scale – Pilot payroll automation in one department before full rollout.

Integrate recruitment early – Use Delonjobs as your single source of hiring truth.

Prioritize compliance – Work with payroll tools that update with Nigeria’s tax laws.

Involve finance teams – Payroll impacts budgeting; collaboration matters.

Automate communication – Automated payslip notifications and reporting boost transparency.

Monitor metrics – Track payroll processing time, error rates, and employee satisfaction.

Keep humans in the loop – Automation supports HR, not replaces it.

What the Next Decade Looks Like

The future of hiring in Nigeria will be defined by speed, and trust. As employers compete for top talent, the companies that can hire fast, pay accurately, and maintain compliance effortlessly will win.

We’ll likely see:

Fully integrated HR ecosystems (Recruitment + Payroll + Performance).

AI-driven workforce planning.

Real-time employee compensation visibility.

Smarter compliance engines that adapt automatically.

Employee self-service portals becoming the norm.

The line between hiring and payroll is blurring and that’s a good thing. Because when those functions work together, employees feel valued, and businesses thrive.

Building the Future of Hiring, Today

The future of hiring in Nigeria will be shaped by those who embraced technology early, not those who wait for the tide to shift. Payroll automation is a cornerstone of this transformation. When combined with digital recruitment platforms like Delonjobs, it unlocks a new era. It creates better candidate experiences, improves employer branding, makes businesses more competitive in a fast-changing market.

Payroll automation is processing salaries faster and building a workplace where:

Employees trust the system.

HR teams focus on strategy, not spreadsheets.

Compliance is automatic, not reactive.

Hiring and payroll flow together as one experience.

Conclusion

Whether you are a growing SME or a multinational expanding in Nigeria,the opportunity is clear; Automate now, lead tomorrow.

And this is exactly the vision behind integrating Delonjobs with HrPayHub.

Delonjobs simplifies talent acquisition, while HrPayHub ensures those talents are paid right, on time, and in compliance. Together, they form an end-to-end talent engine, from job posting to payday.

Transform your hiring and payroll today with Delonjobs and HrPayHub. Your team will thank you.