See how HRPayHub offers enterprise-level payroll features at SME-friendly prices.

When you're launching a business, everyone talks about marketing, sales, and cash flow. What they don't mention is that payroll will consume hours of your life every single month. They don't tell you that one small mistake in pension calculations can cost you N200,000 in penalties. They certainly don't prepare you for the panic that sets in when FIRS sends that audit notice.

Here's what typical payroll processing looks like for most Nigerian SMEs right now: You've got spreadsheets (lots of them), a calculator that's working overtime, and a constant nagging feeling that something's not quite right. You're calculating basic salary, adding allowances, computing PAYE using tax tables you downloaded from somewhere online, figuring out pension contributions, remembering NHF, not forgetting NSITF, and then praying everything adds up correctly.

Then you generate payslips. Then you prepare bank payment files. Then you fill out pension administrator forms. Then you file tax returns. And somehow, despite all this effort, there's still that employee asking why their payslip looks different from last month, or that pension administrator rejecting your submission because the format isn't quite right.

Exhausting? Absolutely. Necessary? Not anymore.

Why Your Current System Is Costing More Than You Think

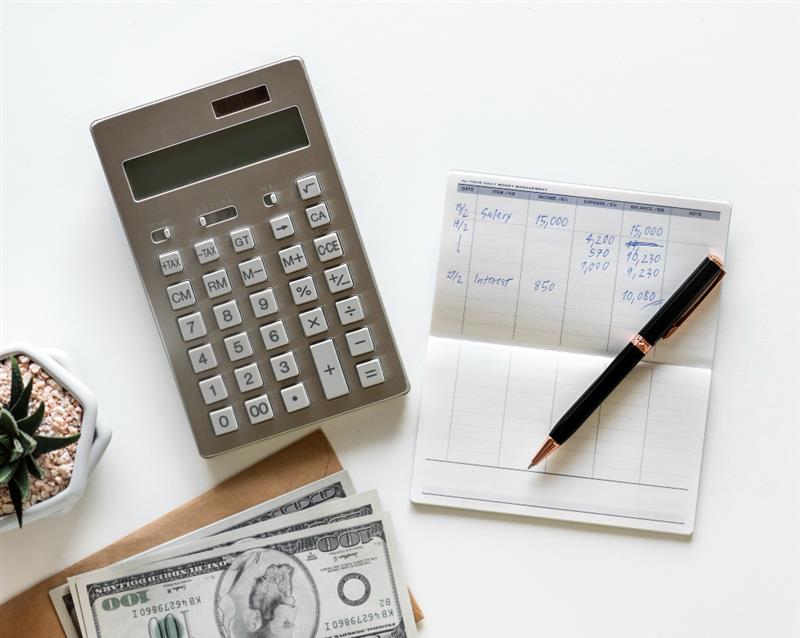

Let's do some quick math together. How many hours do you spend on payroll each month? Be honest. Include the time spent:

- Calculating salaries and deductions

- Double-checking your calculations

- Generating payslips

- Preparing payment files

- Filling out regulatory forms

- Answering employee questions about their pay

- Fixing errors you discover weeks later

If you're like most business owners, you're looking at 15-20 hours monthly. That's three full working days. Every. Single. Month.

Now multiply those hours by what your time is actually worth. If you could spend those 20 hours on business development, client meetings, or strategic planning instead, what would that generate for your business? Probably a lot more than you're "saving" by doing payroll manually.

But wait, there's more (and it gets worse):

The Penalty Problem: Nigerian regulatory bodies don't do warnings. They do penalties. Miss a PAYE deadline? That's N50,000 minimum, plus interest. File pension contributions incorrectly? Another penalty. Get NSITF calculations wrong? You guessed it—more money out the door. Understanding payroll and compliance management isn't just good practice; it's financial survival.

The Error Tax: Made a calculation mistake that underpaid an employee for three months? You're not just paying the backlog. You're dealing with damaged trust, potential legal issues, and the very real possibility that your best people start job hunting. Employee retention, as discussed in our guide on employee engagement in Nigerian businesses, depends heavily on payroll reliability.

The Stress Surcharge: This one doesn't show up on balance sheets, but it's real. The anxiety before every pay cycle, the sleepless nights wondering if you got everything right, the dread when you see an email from FIRS—these have a cost. Your health, your focus, your ability to make good business decisions—all affected.

So no, manual payroll isn't free. It's actually one of the most expensive "free" things you can do.

What Nigerian Businesses Actually Need

Here's the thing about Nigeria: we're not like other markets. We can't just buy any payroll software off the shelf and expect it to work. Our tax system is unique. Our statutory deductions are specific. Our regulatory requirements are... let's call them "detailed."

A payroll system built for American businesses doesn't know what NHF is. European software has never heard of NSITF. Even African solutions from other countries don't quite get our particular flavor of compliance complexity. That's why sector-specific payroll management matters so much—you need tools built for Nigerian realities, not adapted from foreign templates.

What does "built for Nigeria" actually mean? It means software that:

Speaks Nigerian Payroll: Understands that basic salary, housing allowance, and transport allowance aren't just different numbers—they're different categories with different tax treatments. Knows that pension contributions are calculated differently for contributory and non-contributory employees. Gets that NHF only applies when basic salary exceeds a certain threshold.

Stays Updated Automatically: When FIRS changes tax brackets (and they will), your software updates without you lifting a finger. When pension contribution rates adjust, the system knows before you do. When new compliance requirements roll out, you're already compliant.

Generates the Right Files: Pension administrators want specific Excel formats. FIRS needs particular report structures. Your bank requires payment files formatted just so. Nigerian-built software knows all this and generates exactly what each institution expects.

Handles Naira and Nigerian Banking: This sounds obvious until you've used international software that wants to convert everything to dollars or euros, doesn't understand Nigerian bank codes, and generates payment files your bank can't process.

Debunking the "Too Expensive" Myth

"Payroll software costs too much for SMEs."

If you believe this, you're not wrong—you're just looking at the wrong software. Traditional enterprise solutions do cost a fortune. We're talking N150,000 to N300,000 monthly, plus setup fees that could fund a small car purchase. For SMEs, that's impossible math.

Affordable no longer means inadequate. The old equation where you had to choose between "cheap and useless" or "comprehensive and unaffordable" has been completely rewritten. The challenges faced by Nigerian SMEs around software costs are finally being addressed by companies that understand both the budget constraints and the feature requirements.

Think about what you're actually paying for with good payroll software:

Time Buyback: Those 20 hours monthly you're spending on payroll? You're buying them back. At N10,000 per hour (a very modest valuation), that's N200,000 monthly in reclaimed time. What's the software cost compared to that?

Penalty Insurance: How much is it worth to never worry about compliance penalties again? If automated software prevents even one N200,000 penalty per year, it's paid for itself multiple times over.

Error Elimination: Calculate the cost of your last payroll error. The correction, the embarrassment, the damage control. Now multiply by how many errors you're likely to make manually over a year. Software prevents all of that.

Stress Reduction: What's your peace of mind worth? Knowing that payroll will run correctly, on time, every single month without you losing sleep—that's priceless.

When you look at true cost versus value delivered, affordable payroll software doesn't just make sense. It's one of the highest-ROI investments you can make in your business.

The Features You Can't Compromise On

Not all payroll software is created equal. Some tools are basically just fancy calculators with a print function. Real payroll automation requires specific capabilities, and you shouldn't settle for less.

Automatic Statutory Calculations

This is non-negotiable. Your software must automatically calculate:

- PAYE based on current tax brackets

- Employee pension contributions (minimum 8%)

- Employer pension contributions (minimum 10%)

- NHF deductions (2.5% of basic salary where applicable)

- NSITF contributions

And when rates change, the software must update automatically. You shouldn't need to manually adjust formulas or update tables. That defeats the entire purpose of automation.

Smart Salary Structuring

Nigerian salaries aren't simple. You've got basic salary, multiple allowances, benefits, and deductions all playing together. Your payroll system needs to:

- Handle unlimited salary components

- Apply correct tax treatment to each component

- Manage loan deductions, advances, and special payments

- Process bonuses and commissions accurately

- Support different pay frequencies if needed

If your software can't handle your actual salary structure, it's not actually helping you.

Compliant Reporting

At the end of the day (or month, or year), you need reports. Lots of them. And they need to be exactly right:

- Bank upload files formatted for Nigerian banks

- Pension administrator submissions in required formats

- FIRS tax returns ready to file

- NSITF remittance documentation

- Employee payslips that are clear and professional

- Management reports showing labor costs and trends

The software should generate all of this automatically. No manual formatting, no copying and pasting, no "close enough" approximations.

Employee Self-Service

This is a game-changer that many business owners overlook. When employees can log in and access their own payroll information, magic happens:

- "When am I getting paid?" → They check the portal

- "Can I get my payslip?" → They download it themselves

- "How much leave do I have?" → It's right there in the system

- "I need a tax certificate" → Generated instantly

Your HR team stops being an information desk and starts doing strategic work. Workplace discrimination concerns and other HR issues get properly documented and managed when you have a comprehensive system tracking everything.

Integration That Actually Works

Your business doesn't run on islands. Payroll connects to HR, accounting, time tracking, and banking. Quality software integrates all of these:

- HR data flows into payroll automatically

- Payroll entries post to accounting without manual journal entries

- Time and attendance data feeds directly into salary calculations

- Bank payments process smoothly without manual file creation

When systems talk to each other, you stop being a data entry clerk and become a business manager again.

How HRPayHub Changes the Game

Alright, let's talk solutions. You need affordable payroll software that actually works. That's exactly what HRPayHub deliversenterprise features without enterprise pricing.

Pricing That Makes Sense

HRPayHub uses a tiered approach: Bronze, Silver, Gold, and Platinum. This matters because:

You Start Where You Are: Small business with basic needs? Bronze gives you solid employee management features without paying for things you don't need yet.

You Scale Without Pain: Growing? Move to Silver for enhanced HR capabilities, then Gold for full payroll automation, then Platinum for complete business integration. Your pricing grows logically with your needs.

You Never Outgrow the Platform: Whether you have 5 employees or 500, the system handles it. No forced migrations, no starting over, no dramatic price jumps that don't match your growth.

Check out the detailed pricing breakdown to see exactly what each tier includes. The transparency is refreshing—no hidden fees, no surprise charges, no "contact us for pricing" games.

Built for Nigerian Business Reality

Every feature in HRPayHub was designed with Nigerian compliance in mind. This isn't international software with a "Nigeria plugin." It's ground-up Nigerian:

- Tax calculations use actual FIRS brackets and update automatically

- Pension computations follow exact regulatory requirements

- NHF and NSITF are built-in, not afterthoughts

- Reports generate in formats Nigerian institutions actually accept

- Support team understands Nigerian payroll challenges intimately

When software truly understands your environment, everything just works. No workarounds, no manual adjustments, no "good enough" compromises.

More Than Just Payroll

Here's where things get interesting. You come for the payroll automation, but you stay for the complete business management platform:

Leave Management: Automated tracking, approval workflows, balance calculations. No more confusion about who's off when or how much leave everyone has remaining.

Performance Management: Structured 360° appraisals that turn painful annual reviews into continuous development conversations.

Document Management: All employment contracts, policies, certificates, and records in one secure, organized place. Audit-ready documentation without the filing cabinet chaos.

Time Tracking: Accurate attendance data that flows directly into payroll. No more manual timesheet processing or calculation disputes.

Financial Integration: Payroll expenses automatically posting to your accounting system. Real-time visibility into labor costs without reconciliation headaches.

Task and Expense Management: (Platinum tier) Complete operational oversight beyond just payroll and HR.

This comprehensive approach means fewer systems to manage, less data to manually transfer, and better insights into your business operations.

Support That Gets It

Payroll emergencies don't follow office hours. Deadlines don't care if it's Friday evening. When you need help, you need it now. HRPayHub's support team understands that payroll problems are urgent business problems, not "we'll get back to you Tuesday" situations.

Plus, there are resources beyond direct support:

Free Tools: Use the free tax calculator to verify calculations or check your current manual process against automated accuracy.

Educational Content: The HRPayHub blog continuously publishes insights on payroll best practices, compliance updates, and HR management strategies. Stay informed without needing to hire a compliance consultant.

Specialized Solutions: Even if you're in unique situations like managing UK pharmacy operations alongside Nigerian businesses, HRPayHub has experience with international payroll complexity.

Starting your Payroll Journey

Change is scary. You're probably thinking: "This sounds great, but migration seems complicated." Fair concern. Here's the reality: switching to proper payroll software is simpler than continuing to struggle with inadequate systems.

Step One: Face the Reality

Calculate what your current approach actually costs. Not just money—time, stress, risk. Write it down. This number is your motivation to make a change.

Step Two: Define Your Needs

What features do you absolutely need right now? What would make your life significantly easier? What's your budget? Having clear answers helps you evaluate options objectively.

Step Three: Explore HRPayHub

Visit HRPayHub, review the pricing tiers, and see which level matches your needs. Most Nigerian SMEs find the Gold tier hits the sweet spot of comprehensive payroll automation at reasonable pricing.

Step Four: Test Drive It

Request a demo. Play with the interface. Process a mock payroll. Verify that it handles your specific situations. Don't buy based on descriptions—verify with actual usage.

Step Five: Plan Implementation

If it fits (and it probably will), plan your rollout. HRPayHub's team helps with data migration, system setup, and team training. Most businesses are fully operational within two weeks.

Step Six: Enjoy Your Freedom

Once you're live, you'll wonder why you waited so long. That's not marketing talk—it's what happens when you stop fighting with payroll and start focusing on business growth.

Conclusion

Every day you delay costs you time, money, and peace of mind. Every payroll cycle you process manually is another cycle of unnecessary stress. Every regulatory deadline you face with inadequate systems is another risk you're accepting unnecessarily.

But here's the good news: you can change all of that starting today.

Nigerian businesses in 2025 have access to world-class payroll automation at prices that make sense for SME budgets. Enterprise capabilities are no longer reserved for enterprise-sized companies. The democratization of business technology means your 20-person company can access the same quality tools as a 2,000-person corporation.

Visit HRPayHub now and see exactly how enterprise-level payroll features fit into your SME budget. Explore the pricing options and find the tier that matches where your business is today and where you want it to go tomorrow.

Transform payroll from a monthly nightmare into a smooth, automated process that runs in the background while you focus on what actually matters: growing your business, serving your customers, and building something remarkable.

Your employees deserve reliable, accurate payroll. Your business deserves efficient, integrated systems. You deserve to stop losing sleep over tax calculations and compliance deadlines.

The revolution in affordable payroll software for Nigerian businesses isn't coming—it's here. It's real. It's accessible. And it's waiting for you to claim it.