Avoid common mistakes when using Tax Calculator Nigeria. Learn the right way to calculate PAYE deductions and net income to maximize your take-home pay.

Ever wondered why your actual take-home pay doesn't match what you calculated online? You're definitely not alone. Thousands of Nigerian employees struggle with PAYE calculations every month, often making costly mistakes that affect their financial planning and budgeting.

Whether you're negotiating a new job offer or trying to understand your current payslip, getting your PAYE calculation right is crucial. The difference between accurate and inaccurate calculations can mean thousands of naira in your pocket – or out of it.

Let's walk through the most common mistakes people make when using tax calculator Nigeria tools and, more importantly, how to avoid them. By the end of this guide, you'll have the confidence to calculate your PAYE accurately and make smarter financial decisions.

Understanding PAYE in Tax Calculation

PAYE stands for Pay As You Earn – it's how the government collects income tax directly from your salary before you even see it. Think of it as an automatic deduction system where your employer handles the math and sends your tax to the government on your behalf.

The Nigerian PAYE system uses progressive tax rates, meaning you pay different percentages on different portions of your income. The current rates are:

- First ₦300,000 annually: 7%

- Next ₦300,000 (₦300,001 - ₦600,000): 11%

- Next ₦500,000 (₦600,001 - ₦1,100,000): 15%

- Next ₦500,000 (₦1,100,001 - ₦1,600,000): 19%

- Next ₦1,600,000 (₦1,600,001 - ₦3,200,000): 21%

- Above ₦3,200,000: 24%

Here's the key point many people miss: you don't pay the highest rate on your entire salary. You only pay each rate on the corresponding income band. This progressive system is designed to be fairer, but it makes calculations more complex.

Mistake 1: Forgetting About Tax Reliefs and Allowances

This is probably the biggest money-waster when calculating PAYE. Many people skip tax reliefs entirely, leading to massive overestimation of their tax liability.

The Consolidated Relief Allowance (CRA) alone can save you thousands of naira monthly. It's calculated as the higher of:

- 1% of your gross income plus ₦200,000 annually, or

- 20% of your gross income

For someone earning ₦500,000 monthly (₦6 million annually), the CRA would be ₦1.2 million – that's ₦1.2 million of income that's completely tax-free.

Other important reliefs include:

- Pension contributions: Your mandatory 8% pension contribution reduces your taxable income

- National Housing Fund (NHF): The 2.5% NHF contribution is also deductible

- Rent relief: You can claim up to ₦500,000 annually for rent payments

- Life insurance premiums: These can be deducted within certain limits

When using any tax calculator Nigeria platform, make sure it includes all these reliefs. Missing them could cost you hundreds of thousands of naira in unnecessary tax payments.

Professional payroll services automatically account for these reliefs, ensuring you never miss out on legitimate tax savings.

Mistake 2: Confusing Gross Income with Taxable Income

Here's where things get interesting – and where most calculation errors happen. Your gross salary isn't what gets taxed. Your taxable income is what remains after deducting reliefs and allowances.

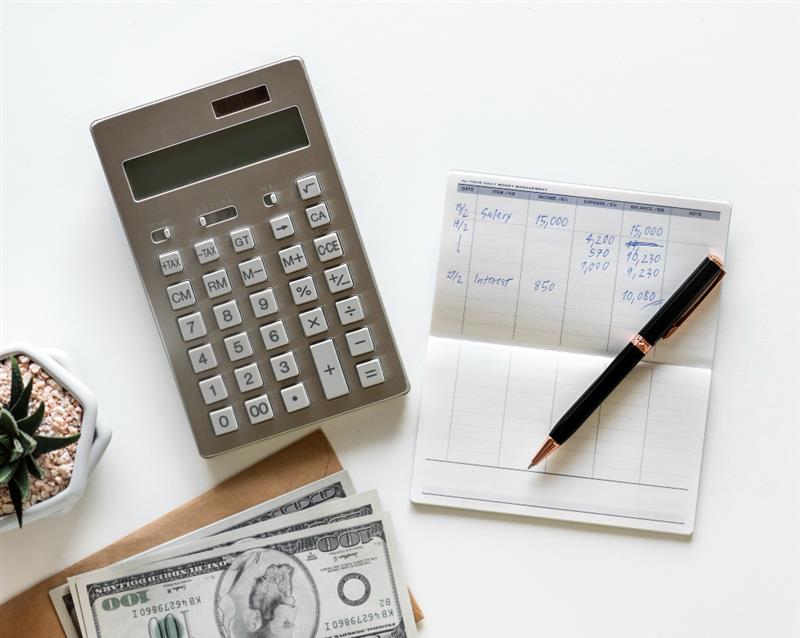

Let's break this down with a practical example. If you earn ₦400,000 monthly:

- Gross annual income: ₦4,800,000

- Less: Pension contribution (8%): ₦384,000

- Less: NHF contribution (2.5%): ₦120,000

- Less: Consolidated Relief Allowance (20%): ₦960,000

- Taxable income: ₦3,336,000

That's a difference of almost ₦1.5 million! Using gross income instead of taxable income in your calculations will dramatically overestimate your tax liability.

Always ensure your tax calculator Nigeria tool works with taxable income, not gross income. This single correction can save you thousands of naira monthly.

Mistake 3: Ignoring Minimum Tax Requirements

Here's a curveball that catches many people off-guard: minimum tax. Even with all your reliefs and allowances, there's a floor below which your tax cannot fall.

The minimum tax is calculated as 0.5% of your gross income annually. So if you earn ₦3 million annually, your minimum tax is ₦15,000 for the year, regardless of how many allowances you have.

This particularly affects people with significant allowances or those working for companies with extensive benefit packages. You might calculate your PAYE as ₦5,000 monthly based on reliefs, but you'll still need to pay at least ₦1,250 monthly (₦15,000 ÷ 12) as minimum tax.

Most basic tax calculator Nigeria tools don't account for minimum tax, leading to underestimation of actual tax liability.

Mistake 4: Using Outdated Tax Information

Tax laws change, and what worked last year might not be accurate today. Nigeria's tax landscape has evolved significantly, with new reliefs, updated rates, and revised calculation methods.

The recent updates to Nigerian tax law brought several changes including enhanced relief allowances and new deduction categories. Using outdated information can result in calculation errors worth thousands of naira.

Before using any tax calculator Nigeria platform, verify it reflects current tax year rates and allowances. When in doubt, consult professional HR services that stay current with tax law changes.

Mistake 5: Overlooking Benefits-in-Kind

This mistake often catches higher-earning employees by surprise. Benefits-in-kind (BIK) like company cars, housing allowances, meal subsidies, and other perks are often taxable and must be included in your PAYE calculation.

Common taxable benefits include:

- Housing allowance: Often the largest component

- Car allowance or company vehicle: Has specific valuation rules

- Meal subsidies: Usually fully taxable

- Medical allowances: May be partially taxable

- Educational allowances: Often taxable above certain limits

The tax value of these benefits varies. For example, rent-free accommodation is typically valued at up to 20% of your gross income for tax purposes.

If you receive ₦800,000 basic salary plus ₦200,000 housing allowance monthly, your gross income for tax purposes is ₦1,000,000, not ₦800,000. This significantly affects your PAYE calculation.

When using a tax calculator Nigeria tool, include all monetary and non-monetary benefits to get accurate results.

Mistake 6: Missing State-Specific Considerations

While PAYE rates are federally standardized, some states have additional requirements or different implementations that can affect your calculations.

Certain states may have:

- Additional development levies for high earners

- Different approaches to housing allowance calculations

- Specific requirements for expatriate employees

- Variations in minimum tax implementation

Research your state's specific requirements before finalizing your PAYE calculations. This is especially important if you're considering jobs in different states or relocating for work.

Mistake 7: Poor Conversion Between Annual and Monthly Figures

PAYE is calculated annually but deducted monthly, creating opportunities for conversion errors. This becomes particularly tricky when dealing with:

- Mid-year salary increases

- Bonus payments

- Overtime earnings

- Unpaid leave periods

- 13th month salaries

Your monthly PAYE deduction might vary throughout the year depending on these factors. A bonus in March could increase your monthly PAYE deductions for the rest of the year to ensure you don't underpay annually.

Professional payroll management systems handle these complexities automatically, ensuring accurate monthly deductions that align with annual tax liability.

Mistake 8: Failing to Plan for Year-End Adjustments

Your PAYE calculations throughout the year should align with your actual annual tax liability. If they don't, you'll face year-end adjustments – either additional payments or refunds.

Common scenarios requiring year-end adjustments:

- Overpayment: You get a refund (good problem to have!)

- Underpayment: You owe additional tax (budget nightmare)

- Job changes: Different employers might calculate PAYE differently

- Bonus timing: Large bonuses can push you into higher tax brackets

Smart employees use accurate PAYE calculations for more than budgeting – they use them for strategic tax planning and compensation negotiations.

Regular tax advisory services help you stay ahead of these considerations throughout the year.

Choosing the Right Tax Calculator Nigeria Platform

With so many potential pitfalls, how do you ensure accurate calculations? The answer lies in choosing the right tools and understanding their limitations.

Look for tax calculator Nigeria platforms with these features:

- Current compliance: Uses latest tax rates and allowances

- Comprehensive reliefs: Includes all available deductions

- Benefits inclusion: Accounts for benefits-in-kind

- Minimum tax consideration: Applies minimum tax rules

- Regular updates: Stays current with tax law changes

However, even the best online calculators have limitations. They work well for standard situations but might struggle with:

- Multiple income sources

- Complex benefit packages

- Mid-year employment changes

- International assignments

- Specialized allowances

For complex situations, professional payroll services provide accuracy that generic calculators cannot match.

Practical Tips for Accurate PAYE Calculation

Ready to get your calculations right? Follow these practical steps:

Step 1: Gather Complete Information Compile all income sources:

- Basic salary

- All allowances (housing, transport, medical, etc.)

- Benefits-in-kind valuations

- Expected bonuses and overtime

- Any other compensation

Step 2: Calculate Your Reliefs Determine your deductions:

- Consolidated Relief Allowance (20% of gross income)

- Pension contribution (8% of basic salary)

- NHF contribution (2.5% of basic salary)

- Life insurance premiums

- Qualifying rent payments

Step 3: Determine Taxable Income Subtract total reliefs from gross income to get taxable income.

Step 4: Apply Tax Rates Use the progressive tax rates on your taxable income, not gross income.

Step 5: Check Minimum Tax Ensure your calculated tax meets the 0.5% minimum tax requirement.

Step 6: Convert to Monthly Divide annual tax by 12 for monthly deduction estimates.

The Employer Perspective: Supporting Employee Understanding

Smart employers recognize that helping employees understand their PAYE benefits everyone. When employees accurately understand their take-home pay, they:

- Make better financial decisions

- Experience less financial stress

- Are more satisfied with compensation packages

- Can negotiate more intelligently

Progressive companies invest in:

- Comprehensive payroll systems with detailed breakdowns

- Employee education on tax calculations

- Professional tax advisory support

- Clear communication about compensation packages

These investments improve employee satisfaction and reduce turnover.

Beyond PAYE: Building Financial Wellness

Accurate PAYE calculation is the foundation of sound financial planning. Once you understand your true take-home pay, you can:

Create Realistic Budgets Base monthly budgets on actual net income, not rough estimates or gross salary figures.

Plan Career Moves Strategically

Understand how salary increases affect net income, accounting for progressive tax rates and benefit changes.

Optimize Compensation Packages Work with employers to structure compensation in tax-efficient ways.

Build Long-term Wealth Use accurate income projections for investment planning and major financial decisions.

Professional financial consulting services can help you leverage accurate PAYE calculations for comprehensive wealth building.

The Technology Advantage

Modern payroll technology makes accurate PAYE calculation easier than ever. Advanced systems offer:

- Real-time tax calculations

- Automatic updates for law changes

- Integration with pension providers

- Detailed employee reporting

- Mobile accessibility

Companies using modern HR technology solutions provide employees with tools for accurate financial planning while reducing administrative complexity.

Common Questions About PAYE Calculation

Q: Can I reduce my PAYE legally? Yes, through legitimate reliefs like pension contributions, life insurance premiums, and rent payments. Always use legal methods and consult professionals for complex situations.

Q: What if my employer calculates PAYE differently? Employers must follow standard PAYE calculation methods. If you notice discrepancies, discuss them with HR or seek professional tax advice.

Q: Do bonuses affect my monthly PAYE? Yes, bonuses can push you into higher tax brackets and affect your monthly deductions for the remainder of the tax year.

Q: Can I get refunds if I overpay PAYE? Yes, but the process can be complex. Accurate calculation throughout the year is better than seeking refunds later.

Conclusion

Accurate PAYE calculation isn't just about tax compliance – it's about taking control of your financial life. By avoiding these common mistakes, you can:

- Make informed career and salary decisions

- Plan your finances with confidence

- Avoid unpleasant year-end tax surprises

- Optimize your overall compensation

- Build wealth more effectively

The key insight is this: small calculation errors compound over time into significant financial impacts. Getting your PAYE calculation right today affects every financial decision you make going forward.

Don't rely on basic tax calculator Nigeria tools for important financial decisions. Invest time in understanding the system, use comprehensive calculation methods, and seek professional guidance when needed.

Take control of your PAYE calculations today. The financial clarity and confidence that comes from truly understanding your tax obligations and take-home pay is worth the effort.

Ready to optimize your payroll processes and eliminate PAYE calculation errors? Explore comprehensive HR and payroll solutions designed for Nigeria's business environment.