Discover the top 5 salary calculators in Nigeria. Compare features, accuracy, and usability to find the best tool for payroll

When was the last time you actually enjoyed doing payroll calculations?

You're sitting there with your calculator, trying to figure out PAYE deductions, pension contributions, and wondering if you've somehow miscalculated your own salary for the third time this week.

Nigerian tax calculations don't have to be the one of your worst nightmares. With the right salary tax calculator, you can say goodbye to those manual calculation headaches and actually get back to doing what you love (or at least what pays the bills).

So grab your favorite beverage, get comfortable, and let's dive into the five best free salary tax calculators that are making life easier for HR folks, business owners, and pretty much anyone who's ever had to deal with Nigerian payroll.

Why You Actually Need a Good Salary Tax Calculator (Trust Me on This)

Before we jump into our top picks, let's have a real talk about why these calculators aren't just "nice to have" – they're absolute lifesavers.

Nigeria's tax system has rates jumping from 7% to 24% faster than Lagos traffic during rush hour. Add in pension contributions, various allowances, and those tricky minimum tax rules, and suddenly you're juggling more numbers than a circus performer.

Manual calculations? That's a recipe for disaster. One wrong keystroke and suddenly everyone's either overpaid or underpaid, and guess who's getting those "can we talk?" messages from accounting?

The best payroll management isn't just about getting the numbers right – it's about getting them right quickly, consistently, and without losing your sanity in the process.

How We Picked These Champions

Look, we didn't just throw darts at a board and hope for the best. We tested these calculators like they were applying for the most important job in your company (because, let's face it, accurate payroll kind of is).

Here's what we put them through:

- The Accuracy Test: Do they actually get Nigerian tax laws right?

- The Speed Test: Can you get results without aging a decade?

- The User-Friendly Test: Would your least tech-savvy colleague survive using it?

- The Real-World Test: How do they handle the weird scenarios that always pop up?

- The Reliability Test: Do they work when you need them most?

Ready to meet our winners?

1. HRPayHub Salary Tax Calculator: Your New Best Friend

Alright, let's start with the star of the show – HRPayHub's salary tax calculator. And yes, we're putting it at number one for all the right reasons.

This isn't just another calculator that spits out numbers and leaves you guessing. HRPayHub's tool actually explains what it's doing, which is incredibly refreshing when you're trying to understand why your take-home pay looks the way it does.

The interface feels like it was designed by people who actually use payroll calculators (revolutionary concept, right?). You input your gross salary, add any allowances, specify your pension rate, and you get a breakdown that makes sense.

But here's what really sets it apart: it doesn't just calculate; it educates. You'll actually understand your payroll better after using it.

What Makes It Shine:

- Actually follows Nigerian tax laws

- Breaks down calculations step by step

- Handles complex allowance structures like a champ

- Updates regularly with current tax rates

- Interface that doesn't make you want to throw your computer out the window

- Lightning-fast calculations

- Works great for both simple and complex scenarios

Who Should Use It: Honestly? Everyone. But especially HR teams, payroll professionals, business owners, and anyone who wants to actually understand their payroll processing instead of just hoping for the best.

If you're only going to bookmark one salary calculator, make it this one. It's like having a payroll expert sitting right next to you, minus the coffee breath and unsolicited advice about your lunch choices.

2. SME Payroll Nigeria Salary Calculator

Coming in at number two is the SME Payroll Nigeria Salary Calculator, and it's got a serious thing for details. If you're the type of person who likes to know where every naira goes, you're going to love this tool.

What's Great About It: This calculator is like that friend who explains movie plots in excruciating detail – sometimes it's exactly what you need. It provides comprehensive breakdowns that help you understand not just what you're paying in taxes, but why you're paying it.

It's particularly brilliant for business owners who are still getting their heads around Nigerian payroll requirements. The detailed outputs make great learning tools, and you'll find yourself actually understanding payroll instead of just accepting it as some mysterious black box.

The Good Stuff:

- Incredibly detailed breakdowns (we're talking forensic-level detail)

- Great for learning Nigerian tax calculations

- Regular updates with current rates

- User-friendly for payroll newbies

- Solid accuracy for standard scenarios

Where It Could Improve:

- Interface feels a bit dated (but hey, it works)

- Can be overwhelming if you just want quick numbers

- Limited flexibility for unique allowance structures

Perfect For: Small to medium business owners, accounting students, anyone who likes to understand the 'why' behind their numbers, and people who actually read the fine print.

3. Talent.com Nigeria Income Tax Calculator

Third place goes to Talent.com's Nigeria Income Tax Calculator, and there's a reason it's so popular with individual users. It's like the friendly neighborhood calculator that everyone actually wants to use.

Why People Love It: This calculator gets it. Most people don't want to become payroll experts; they just want to know how much they're taking home. Talent.com delivers exactly that without the complexity that makes your eyes glaze over.

The interface is clean, modern, and doesn't assume you have a degree in Nigerian tax law. You can quickly compare different salary scenarios, which is incredibly useful during job negotiations or when you're dreaming about that promotion.

The Highlights:

- Super user-friendly (your grandmother could use this)

- Fast and reliable calculations

- Great for comparing salary offers

- Shows both monthly and annual breakdowns

- Mobile-friendly design that actually works

The Not-So-Great:

- Limited customization options

- Might not handle complex business scenarios

- Less detailed for professional payroll use

Who'll Love It: Employees planning their finances, job seekers comparing offers, small business owners with straightforward payroll, and anyone who values simplicity over complexity.

4. iCalculator Nigeria Salary Calculator

Fourth on our list is iCalculator's Nigeria Salary Calculator, and this one's for the detail-oriented folks who need to justify every calculation. Think of it as the calculator equivalent of that colleague who color-codes their spreadsheets.

What Makes It Special: If accuracy was an Olympic sport, this calculator would be going for gold. It shows you exactly how it arrives at every number, which is fantastic when you need to explain calculations to auditors, bosses, or skeptical employees.

The tool handles complex scenarios really well and maintains high accuracy standards that make it suitable for professional environments where "close enough" isn't good enough.

Ideal Users: Accounting professionals, payroll specialists, businesses with complex requirements, and anyone who needs to provide detailed calculation justifications.

5. Excel Skills Nigeria Tax Calculator

Rounding out our top five is Excel Skills Nigeria Tax Calculator, the Swiss Army knife of salary calculators. It might not be the prettiest, but it's incredibly versatile.

The Standout Features: What sets this calculator apart is its flexibility. Need to integrate salary calculations into your website? Want to customize the interface? This tool's got you covered. It's like the calculator equivalent of that multi-tool you keep in your desk drawer.

The calculator handles various employment scenarios while keeping things relatively simple. It's particularly useful for businesses that want to offer calculator functionality to their clients or employees.

Best Match For: Tech-savvy users, businesses wanting calculator integration, HR consultancies, and people who like customizable tools.

What's in Nigerian Tax law?

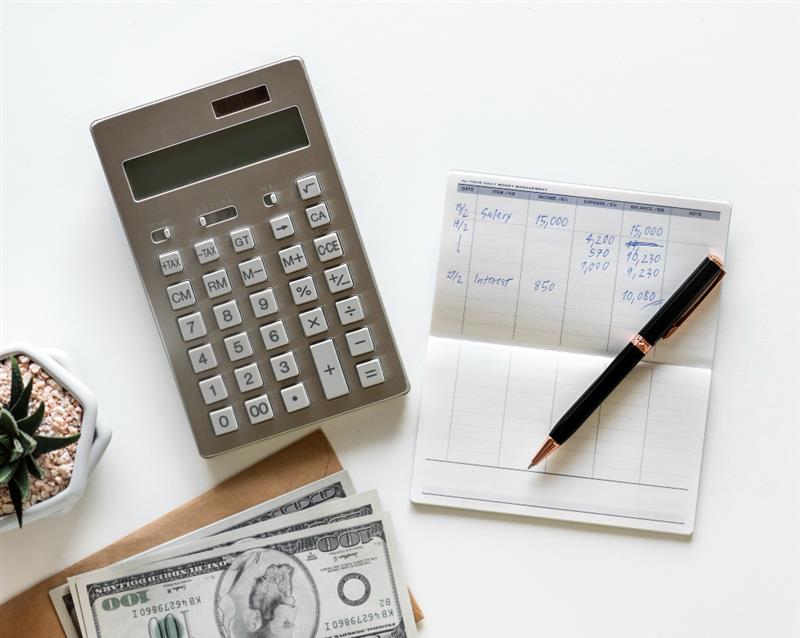

Nigeria's tax system isn't exactly what you'd call "simple." With PAYE rates that jump around like a kangaroo on espresso, plus pension contributions, allowances, and those fun minimum tax provisions, manual calculations are basically asking for trouble.

The PAYE system in Nigeria starts at 7% for lower incomes and climbs to 24% for the big earners. But it's progressive, meaning different chunks of your income get taxed at different rates. Try doing that math in your head after your third cup of coffee.

This is exactly why quality salary tax calculators have become as essential as coffee in most Nigerian offices. They handle the complexity so you don't have to become a tax expert just to figure out your payroll.

What Should You Actually Look For in a Calculator?

Great question! Here's what separates the winners from the "why did I waste my time with this" candidates:

Current and Accurate Tax Information

Your calculator better be up-to-date with Nigerian tax laws. Using outdated rates is like using a map from 1985 to navigate Lagos – you're going to end up in the wrong place.

Handles All the Moving Parts

Look for calculators that manage:

- PAYE calculations across all income brackets

- Pension contributions (usually 8% of gross salary)

- Various allowances and reliefs

- Those tricky minimum tax situations

Actually Usable Interface

If you need a PhD to operate the calculator, it's probably not the right one. The best tools are intuitive enough that you can use them when you're stressed, tired, or dealing with deadline pressure.

Shows Its Work

The top calculators don't just give you numbers; they show you how they got there. This is crucial for verification and explaining results to others.

Speed and Reliability

When payroll deadlines are looming, you need calculations fast. The best tools deliver accurate results quickly and consistently.

Pro Tips for Getting the Most from Your Calculator

Want to become a salary calculator ninja? Here's how:

Test Drive Different Scenarios

Don't just calculate one salary and call it done. Try different income levels, various allowance combinations, and edge cases. This helps you understand your calculator's capabilities and limitations.

Stay on Top of Updates

Tax laws change (shocking, we know). Bookmark your chosen calculator and check periodically for updates. Set a quarterly reminder if you have to.

Cross-Check Important Calculations

For critical payroll calculations or unusual scenarios, consider running numbers through multiple calculators. Better safe than explaining calculation errors to an unhappy employee.

Document Your Process

Create a standard operating procedure for using your calculator. This ensures consistency and makes training new team members much easier.

Keep a Backup Plan

Technology sometimes fails (usually at the worst possible moment). Know where to find alternative calculators or professional payroll services when you need them.

Common Mistakes to avoid in Nigeria Tax Calculation

Learn from others' mistakes instead of making your own:

Ignoring Allowances

Many calculators handle basic salaries like champions but stumble with allowances. Make sure you understand how your chosen tool handles housing, transport, and other allowances.

Assuming Standard Pension Rates

While 8% is typical, some employment agreements have different pension contribution rates. Ensure your calculator can handle variations or that you can adjust manually.

Forgetting About Minimum Tax

Nigerian tax law includes minimum tax provisions that can surprise you. Understand these requirements and how your calculator handles them.

Using Last Year's Information

Tax rates and thresholds can change annually. Always verify you're using current information, especially when processing payroll at year-end or year-beginning.

So, Which Calculator Should You Choose?

Based on our testing and real-world use, here are our honest recommendations:

For Most People: Start with HRPayHub's calculator. It offers the best balance of accuracy, functionality, and ease of use. Plus, it actually helps you understand payroll better.

For Learning: SME Payroll's calculator is excellent if you want to really understand Nigerian payroll calculations in detail.

For Simplicity: Talent.com's tool is perfect if you just need quick, reliable numbers without the complexity.

For Precision: iCalculator is your best bet when you need detailed methodology and professional-grade accuracy.

For Flexibility: Excel Skills calculator works well if you need integration capabilities or customization options.

Conclusion

Payroll calculations don't have to be the bane of your existence. With the right salary tax calculator, you can transform from someone who dreads payroll day into someone who actually feels confident about the numbers.

The best part? You're not locked into any choice forever. Start with one calculator, get comfortable with it, and don't be afraid to explore others as your needs evolve. The key is to begin somewhere and keep improving your payroll processes.

Take some time this week to test out these calculators with your specific scenarios. Find the one that clicks with you, bookmark it, and make it part of your regular workflow. You'll be amazed at how much easier payroll becomes when you have the right tools in your corner.