Nigeria PAYE Filing Made Simple

Why this matters (and why now)

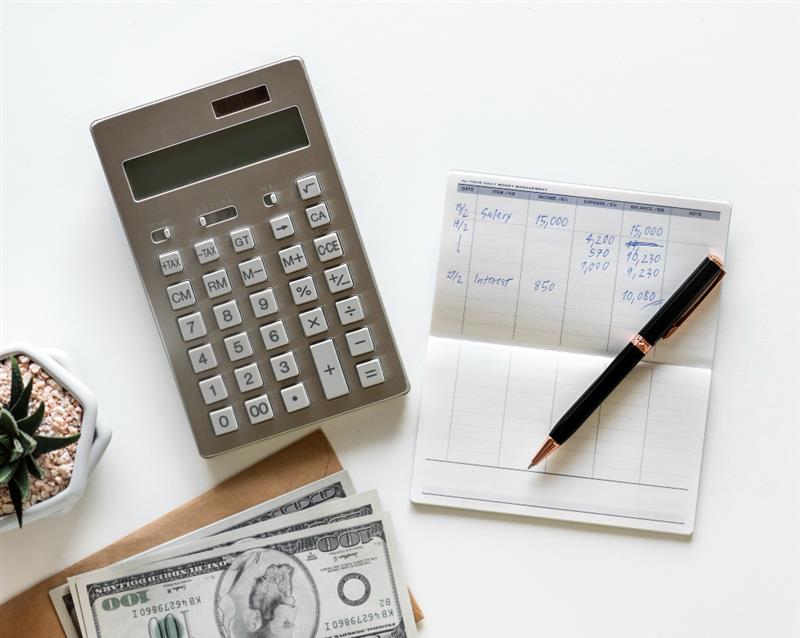

Payroll mistakes are expensive. They drain time, damage trust, and can lead to penalties. In Nigeria, getting PAYE right every month, for every employee, is non-negotiable. Yet HR teams still juggle spreadsheets, copy-paste errors, and outdated rules.

This guide demystifies gross-to-net and shows how HRPayHub’s Free Nigeria Tax Calculator turns complex PAYE math into a clear, auditable breakdown you can use immediately. It also reflects the reality that 2025 is a transition year: current rules remain in force through December 31, 2025, with updated provisions taking effect January 1, 2026. In HRPayHub, you can compare both with a simple toggle.

PAYE in Nigeria: the quick primer

PAYE (Pay-As-You-Earn) is the system where employers deduct personal income tax from employees’ salaries and remit monthly to the relevant State Internal Revenue Service (e.g., LIRS for Lagos). Employers also make annual returns and maintain records that show how each net pay was derived.

At a high level, your payroll journey each month is:

Start with Gross Pay (basic + allowances + bonuses).

Subtract eligible pre-tax deductions (e.g., pension employee portion, NHF).

Apply reliefs and tax rules to compute PAYE.

Subtract PAYE and other statutory deductions to reach Net Pay.

Remit PAYE and other statutory contributions and keep audit evidence.

The details matter, especially how you classify earnings, which deductions are pre-tax vs post-tax, and how you apply reliefs.

Common payroll mistakes (and how to avoid them)

Mixing employer and employee portions

Keep employer statutory costs off the employee’s payslip totals. Your P&L needs the right split.

Wrong order of operations

If you subtract deductions in the wrong order (e.g., after PAYE instead of before), your taxable income will be wrong, and so will PAYE.

Copying last year’s rules

Rules evolve. Ensure your calculator is updated with current and upcoming regimes so you don’t under- or over-deduct.

Manual rounding and proration errors

Month-to-month variations (new joiners, exits, unpaid leave) require precise proration. Let the system handle rounding and cut-off logic.

Poor evidence trails

Regulators and auditors look for who changed what and when. Keep a digital trail—inputs, approvals, exports, and remittance receipts.

Step-by-step: Use HRPayHub’s Free Nigeria Tax Calculator

You don’t need to be a tax expert. Follow these steps:

Choose the regime

“Current Law (through Dec 31, 2025)” or “New Law (from Jan 1, 2026)”.

Want to show impact? Calculate both and compare.

Select profile: Employee or Contractor

The underlying logic changes automatically (PAYE vs contractor modeling).

Enter earnings

Input basic salary, allowances, bonus/commission if any. You can paste monthly or annual figures—the tool annualizes properly.

Toggle statutory options

Switch on/off Pension (employee), NHF, and other contributions as applicable to your organization. Built-in validations nudge you to complete required fields.

Review the breakdown

See Taxable Income, PAYE, Pension (employee), NHF, and the final Net Pay. If something looks off, adjust inputs and the breakdown updates instantly.

Export / Save

Download a PDF breakdown or copy the line items into your payroll journal template. (If you’re an HRPayHub user, you can send results directly to payroll and keep the evidence trail.)

Three practical scenarios (what the calculator reveals)

Values vary by salary and regime; the point here is the shape of the result and what to watch.

Scenario A: Entry-level staff with basic + transport + housing

Why it matters: Shows how allowances affect taxable income and why pre-tax items matter.

What you’ll see:

Turning on Pension (employee) and NHF reduces Taxable Income → lower PAYE → higher Net Pay than you expected from a simple “gross minus PAYE” guess.

A small change in allowances can change the net more than a similar change in basic, depending on rules and reliefs.

Scenario B: Mid-career staff with a bonus and a loan repayment

Why it matters: Bonuses change the banding; loans are post-tax deductions.

What you’ll see:

Bonus increases taxable income; PAYE rises accordingly.

Loan repayment shows as a separate post-tax deduction. Your employees will understand why their net dipped this month, and your evidence stays clean.

Scenario C: Employee vs Contractor at the same “headline” gross

Why it matters: Helps candidates/managers make informed decisions.

What you’ll see:

Contractor’s “take-home” can look higher on an invoice basis, but the employee scenario includes retirement savings, benefits, and employer contributions that the contractor must self-fund.

HR can point to a neutral, calculator-based comparison to avoid misunderstandings.

PAYE filing timeline at a glance (orientation guide)

Monthly: Deduct PAYE from salaries and remit to the appropriate State IRS by the required date. Keep schedules, proofs of payment, and reconciliation.

Annually: File employer annual returns and maintain year-end summaries. Provide employees with the documentation they need for personal records and any returns.

Best practice: Maintain a centralized remittance calendar, with reminders, responsible owners, and a checklist of required attachments/receipts.

Tip: If your company operates in multiple states, ensure each employee’s PAYE goes to the correct state based on applicable residency/place-of-work rules and your tax advisor’s guidance.

Why HR teams love the calculator (and what happens next)

No more guesswork: The calculator applies the correct order of operations and reliefs for the selected regime.

Built-in validations: Prompts for missing fields, caps where relevant, and sensible defaults reduce errors.

Audit-ready exports: Save the breakdown for your payroll file and remittance support docs.

Education tool: New HR staff, line managers, and candidates grasp gross-to-net quickly.

When you’re ready to move from “single-paycheck accuracy” to “end-to-end payroll confidence,” HRPayHub’s full suite takes over:

Nigeria Payroll Automation: Bulk imports, grade/allowance rules, and journal exports to accounting.

Self-Service: Employees can view payslips, leave balances, and update profiles—fewer HR tickets.

Offer Letters + E-Signature: Templates with dynamic fields and an evidence timeline.

Pay-As-You-Go Filings (Beta): Salary remittance, PAYE (Monthly & Annual), VAT, WHT, and FIRS Annual Filing handled end-to-end for Platinum clients.

Audit Trails & Security: Role-based access (RBAC) and activity logs across payroll operations.

“New law” vs “Current law”: model both in seconds

2025 is a bridge year. Many teams want to know how 2026 updates will affect take-home and budgeting. In the HRPayHub calculator, you can:

Run 2025 (current) and 2026 (new) side by side.

Capture screenshots or export both breakdowns for your leadership pack.

Decide if you need to re-tune salary structures or allowances ahead of January.

This planning view is essential for workforce cost forecasting, offer calibration, and employee communication.

What makes it stand out?

✅ Two versions in one: Current tax law (valid until Dec 31, 2025) + New tax law (effective Jan 1, 2026, signed by President Bola Tinubu)

✅ Full-time vs Contractor options: Easily calculate deductions based on your work type

✅ Statutory checks built in: NHF, NSITF, Pension contributions, and more

✅ Designed for accuracy & compliance: Built with HR and payroll professionals in mind

✅ 100% free, reliable, and user-friendly — no hidden costs

Mini checklist: gross-to-net and filing hygiene

All earnings and deductions are labeled clearly (basic, housing, transport, bonus, pension, NHF, etc.)

Employee vs contractor status confirmed (offer letter + HR system)

Calculator regime selected correctly (through Dec 31, 2025 vs from Jan 1, 2026)

Evidence saved (PDF breakdown, payroll journal, remittance receipt)

State remittance calendar up to date (owners, deadlines, attachments)

Reconciliations run monthly; anomalies investigated and documented

FAQs

Q1: Can I use the calculator for any salary level?

Yes. Enter monthly or annual figures; the tool handles annualization and reliefs per the selected regime.

Q2: Do I need to know tax bands and formulas?

No. The calculator applies them automatically. If you’re curious, you can still expand the breakdown to see how taxable income and PAYE were derived.

Q3: Can I model allowances separately?

Absolutely, split them out (housing, transport, etc.) to see the impact of each on taxable income and net pay.

Q4: Does the calculator handle proration for new joiners or exits?

In HRPayHub payroll, yes, the engine prorates based on hire/exit dates and applicable cut-offs. In the free calculator, enter the prorated gross for a quick estimate.

Q5: Will this replace my accountant or tax advisor?

No. The calculator improves accuracy and transparency, but it doesn’t replace professional advice, especially for edge cases or multi-state scenarios.

Put it into practice today

Whether you’re an HR leader, finance manager, or job seeker, understanding gross-to-net is the foundation of clean payroll. With HRPayHub’s Free Nigeria Tax Calculator, you’ll:

Turn gross into net with confidence

Avoid common PAYE mistakes

Produce audit-ready breakdowns and move faster on monthly remittances

Try it now: Visit HRPayHub.com → Tax Calculator (free).

When you’re ready, book a 20-minute demo to see how payroll automation, audit trails, and pay-as-you-go filings fit together.

Disclaimer: This article is for informational purposes only and is not tax advice. For specific cases and multi-state questions, consult a qualified professional.